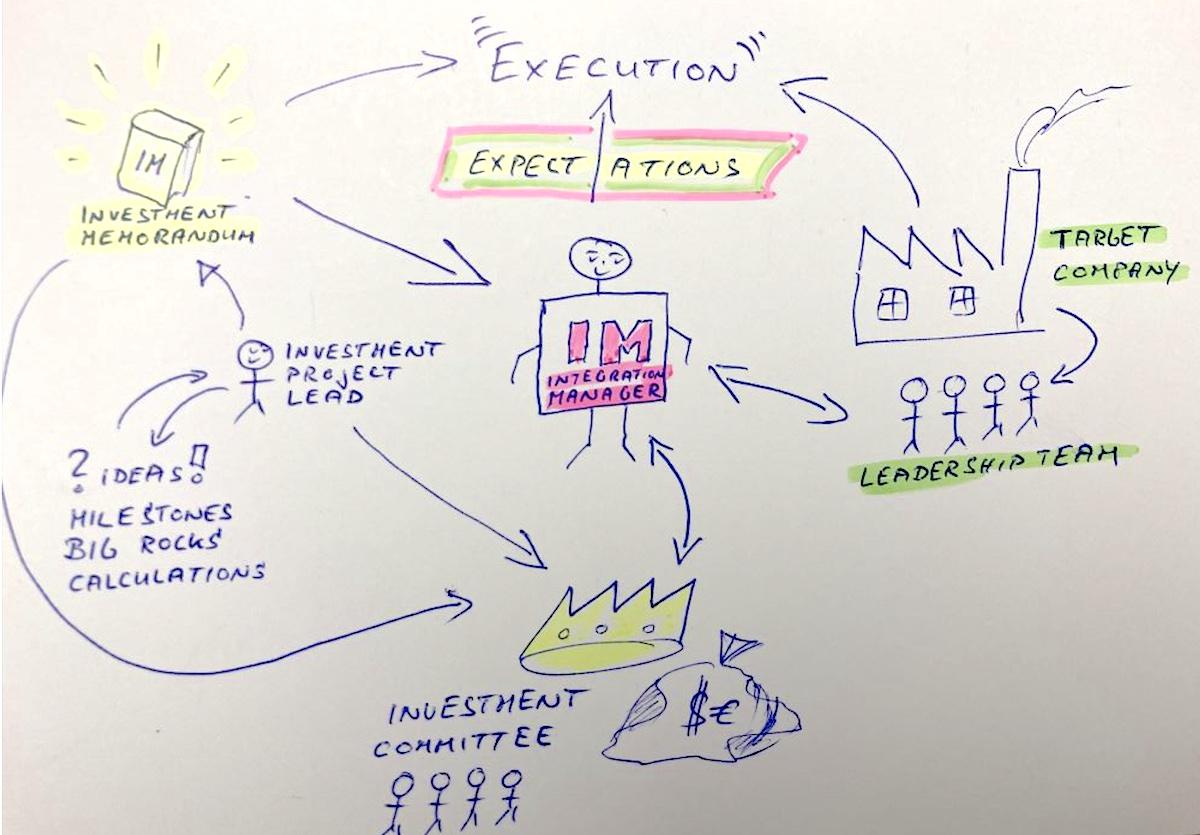

A good post merger integration should be led by a responsible Integration Manager

But let’s start a bit earlier:

Small and medium businesses, family offices, or PE-companies – so different from their organization and their goals. And still: all of them are very active in acquiring companies in highly interesting market segements such as internationalization and translation industry or vertical market software companies.

Spreadsheets & Due Diligence

Myriads of lawyers, tax advisors and financial specialists are comparing spreadsheets about market sizes, expected growth rates, past results and forecasts of turnover and EBIT(DA) of companies they want to invest in. Subject matter experts are investigating the maturity level of industries or a business segment, how fragmented a market is, what are the mega-trends of this industry and surely: who (as an investor) is competing in that special market.

Plans are created, business models re-written, assumptions well formulated and expectations including big rock milestones of re-organization/re-structuring and synergies all put together in an „investment memorandum“. This is the wholy bible of each M&A deal. All further plans and (intermediate) results are being challenged against this investment memorandum.

All well thought and with a high probability of leading to commercial success.

During due diligence it should be expected that all the assumptions being made and documented in that investment memorandum are being verified, confirmed or rejected. If rejected this typically leads to a change in the possible total purchase price of the acquisition target.

The one acquiring a company needs to be aware – and most of them are – that (if it’s not just because of some patents/IP or clients in the exactly same market) it’s not the most important topic to create synergies in saving costs. Instead it is important that the acquired company soon gets on track with what was planned in the investment memorandum.

Integration Manager

That’s why there should be a so-called „integration manager“ helping to arrive and to learn about the new expectations, strategy changes, the culture, etc. the buyer has.

Typically at least some parts of the goals and/or strategy of the existing, former shareholders, as well as C-level executives are in line with the ideas and strategy of the buying company, the new owners. But there also almost every time is a gap in between the two goals/strategies.

People in a company (which also includes existing management) need guidance by a clear vision, mission and strategy.

Changing ownership of a company is like shaking the organization – already existing instabilities and uncertainties get stronger during this process. This might can cause a (negative) dynamic in disagreement, disappointment, bad execution, followed by bad results and last but not least fluctuation.

One of the core responsibilities of a post merger integration manager is to support the process of change, provide security and stability to the whole team (including management). And to make the positive impact of those changes visible. In a smooth yet diligent way, so everybody involed doesn’t feel like being blamed for the past and happily supports that migration.

Here are the top 8 responsibilities you as a post merger integration manager need to be aware of:

- The integration manager, as well as the the TOP leadership team of the acquisition target need to learn to know each other BEFORE signing/closing the SPA: networking

- The integration manager needs to clarify all expectations (from the buyer, as well as the seller, as well as the leadership team of the acquired company). All expectations means: visible expectations and hidden expectations: Clarify them!

- Immediately after signing/closing the integration manager needs to clarify also the boarder lines of what is going to happen and what not: aligning

- The integration manager needs to update often, regulary and structured about where the process is, what maybe has changed, or which challenges came up: transparency

- The integration manager needs to provide the acquired management team pro-actively, and in timely manner all necessary information in order to help them to take quick decisions: speed

- The integration managers job is to prevent all stakeholders from surprises. During an integration process no-one likes surprises: Reliability and consistency

- The integration manager is responsible that the local management team is continously active and acting, not discussing too much about changes and projects: consequence.

The integration managers task is to help the local management team to connect to peers in the acquiring company. To guide them to valuable sharing of experiences other managers already have made: support

Surprisingly enough: although the importance of such a post merger integration manager is clear and agreed, it’s still not state of the art in real life.

„We do not expect synergies between the existing and the acquired companies – therefore we do not need a post merger integration manager.“

A simple but massive error with the potential of risking the success of the whole M&A process.

Do it differently. Do it better.